Rather than worry about the “what-ifs” and what could go wrong, business owners will have immediate cash on hand. Without freight bill factoring, some companies have to stress over capital, cash flow, and have the constant fear a repair may require funds that are not available. Factoring can provide safety for the carrier and the funds to ensure their services will always receive payment.

If a shipper does not pay for the delivery, even in the case of insolvency, the factoring company will take the downfall over the carrier’s business. Non-recourse factoring will take responsibility if the client does not make the payment and takes the loss.

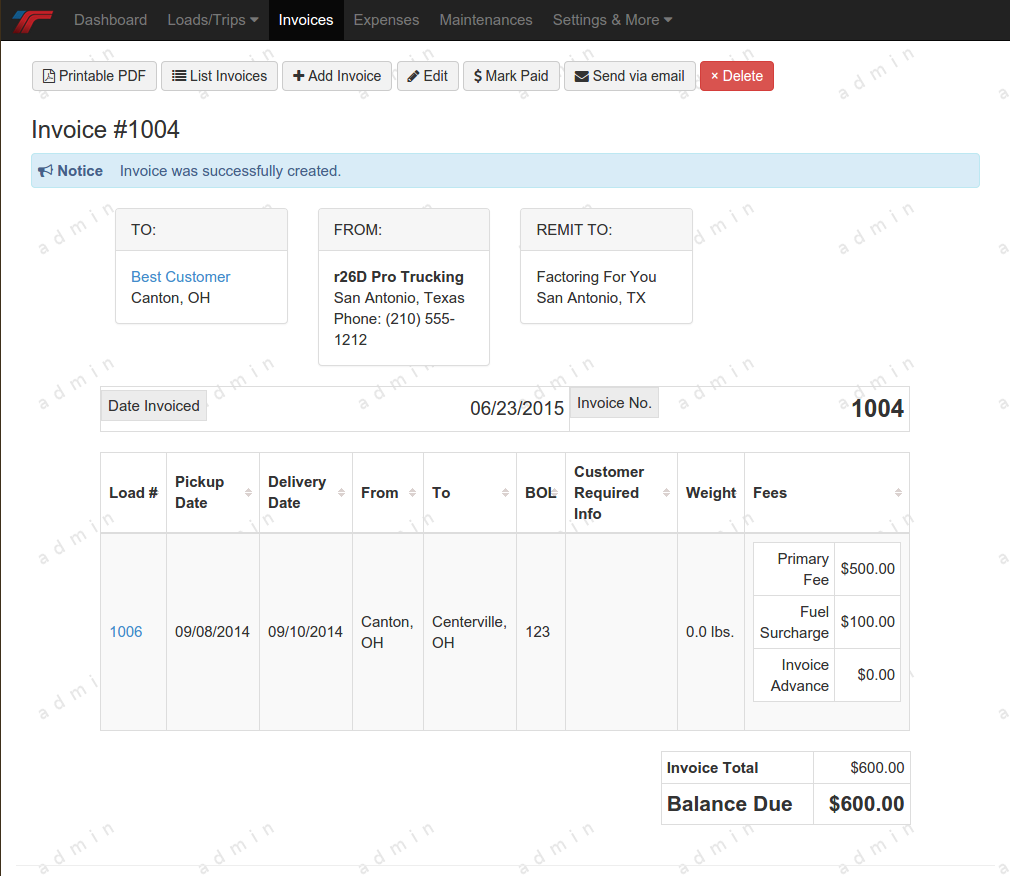

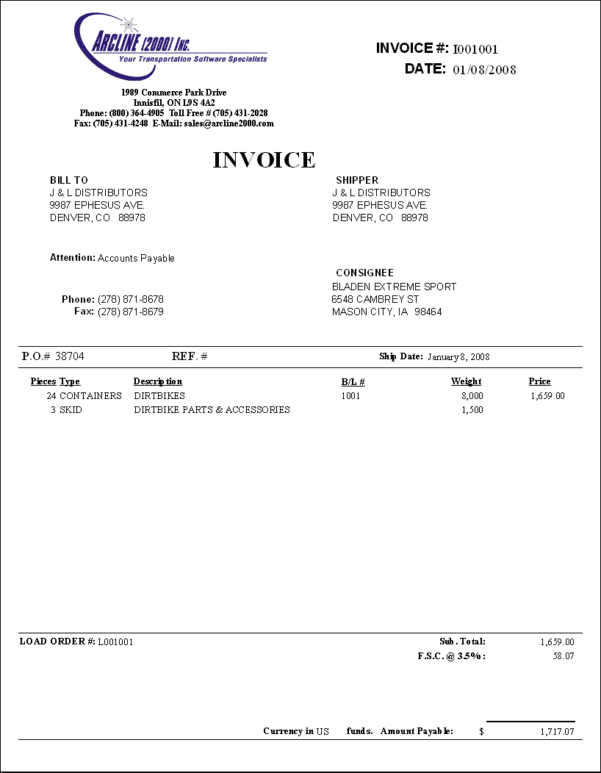

Companies may withhold payment due to bankruptcy or simply go out of business, but with non-recourse factoring, that will not affect your business. Invoice factoring for trucking can protect a company from bad credit and losing money on the delivery, depending on the factoring option. Less Risk Of Bad Debtīad debt occurs when a creditor owes money but is unlikely to pay the bill. Rather than miss out on new loads due to managing office tasks or payments, let invoicing handle the stress of those tasks. With less need to focus on collecting and managing payments, owners can devote more time to finding more freight bill funding and focusing on overall company growth.įor new trucking companies, time management can raise some issues and become overwhelming quite quickly. Rather than stressing over billing and collecting, a factoring company can handle office tasks. Less Time in Managing Paymentsįor some companies, especially owner-operator carriers, a lack of workforce can make managing office tasks impossible. Companies with increased cash flow from invoice factoring companies can be more prepared in case of emergency repairs or if fuel prices spike. Increased cash flow eliminates the need for financing through a bank or using a credit card to cover expenses. Carriers cannot financially go without compensation for operational needs such as drivers, bills, repairs, or investments. Rather than waiting on payments and dealing with a backlog of charges for the business, companies can see increased cash flow with factoring. Improved Cash Flow to Take On More Shippers and Loads As the business grows, shortening the payment window and receiving payment sooner will enable carriers to keep the business booming. Carriers will receive payment for the invoices directly to their bank account from the factoring company within days. Depending on a carrier’s financial position, this quick payment can help ensure fewer gaps in income.įor new companies especially, shortening the payment clock can improve working capital, making or breaking a business. Rather than waiting the average 30,60, or even 90 days for payment, factoring companies often have same-day or next-day payments. Invoicing can help carriers grow their fleet, improve cash flow, and help the company succeed in such a competitive industry. In the trucking industry, the goal is to see advancements in the business and gain more loads. Benefits of Factoring for Truckersįactoring continues to provide immediate payment, which can be extremely beneficial for an owner-operated business. Freight bill and invoice factoring companies can remove the need to rely on bank loans to make ends meet or help a business that may have an extremely tight budget. Factoring can increase cash flow and raise capital for business growth for starting trucking companies or owner-operator trucking businesses. The factoring company will then wait for payment and take that burden off the trucking company. A company will go about regular business and make the delivery but sell the invoice to a factoring company. What is Freight Bill and Invoice Factoring?įreight bill factoring occurs when a company buys the shipment invoice with cash, removing the average wait time for payment. A solution for this problem is freight factoring, which can benefit carriers of any size and longevity. Having to wait on payment can make the entire company suffer and cause problems with cash flow, bad debt, and increasing stress. Grandview Research mentions how the global factoring market is rapidly expanding at a CAGR of 8.4%< but actual growth may supersede that rate as the effects of the e-commerce explosion and the current peak become more evident. Freight factoring is expected to grow even more in the coming years. Starting a trucking company in such a competitive industry has many inherent challenges that can easily bankrupt any business. Trucking invoice factoring can alleviate stress for trucking companies and owner-operators who are currently facing account receivable issues and other additional benefits.

0 kommentar(er)

0 kommentar(er)